In the wild world of financial markets, there is no such thing as certainty. Nevertheless, astute investors use calculated moves to reduce risks and protect their holdings in the middle of mayhem. Futures hedging is one such strategy that is a reliable barrier against market swings. We examine the nuances of hedging with futures in this thorough analysis, elucidating its tenets, tactics, and consequences for market players.

Comprehending Hedging in Futures

Futures hedging is essentially using futures contracts to offset possible gains or losses brought on by unfavourable price fluctuations in the underlying assets. Standardized agreements to purchase or sell a certain amount of a financial instrument or commodity at a predetermined price and date in the future are known as futures contracts. Investors can limit the impact of market changes on their portfolios and efficiently hedge against price volatility by holding opposite positions in futures contracts to their existing exposure in the underlying asset.

The Fundamentals of Futures Hedging

The goal of protecting against unfavourable price changes in underlying assets and the idea of risk management is at the centre of the concepts of futures hedging. Important ideas consist of:

Identification of Risks

Whether it’s price risk, interest rate risk, currency risk, or commodity price risk, investors need to identify the precise risks they want to protect themselves against.

Choosing the Right Futures Contracts

Investors choose futures contracts that closely match the underlying asset or portfolio they want to hedge.

Hedge Ratio Establishment

The ideal hedge ratio, which shows the connection between the amount of the underlying exposure and the hedge position in futures contracts, is decided by investors.

Monitoring and Adjustments

To ensure efficient risk reduction and portfolio protection, investors keep an eye on market conditions and make necessary adjustments to their hedge positions.

Techniques for Using Futures in Hedging

Futures hedging involves many techniques, each adapted to particular market circumstances and investor goals:

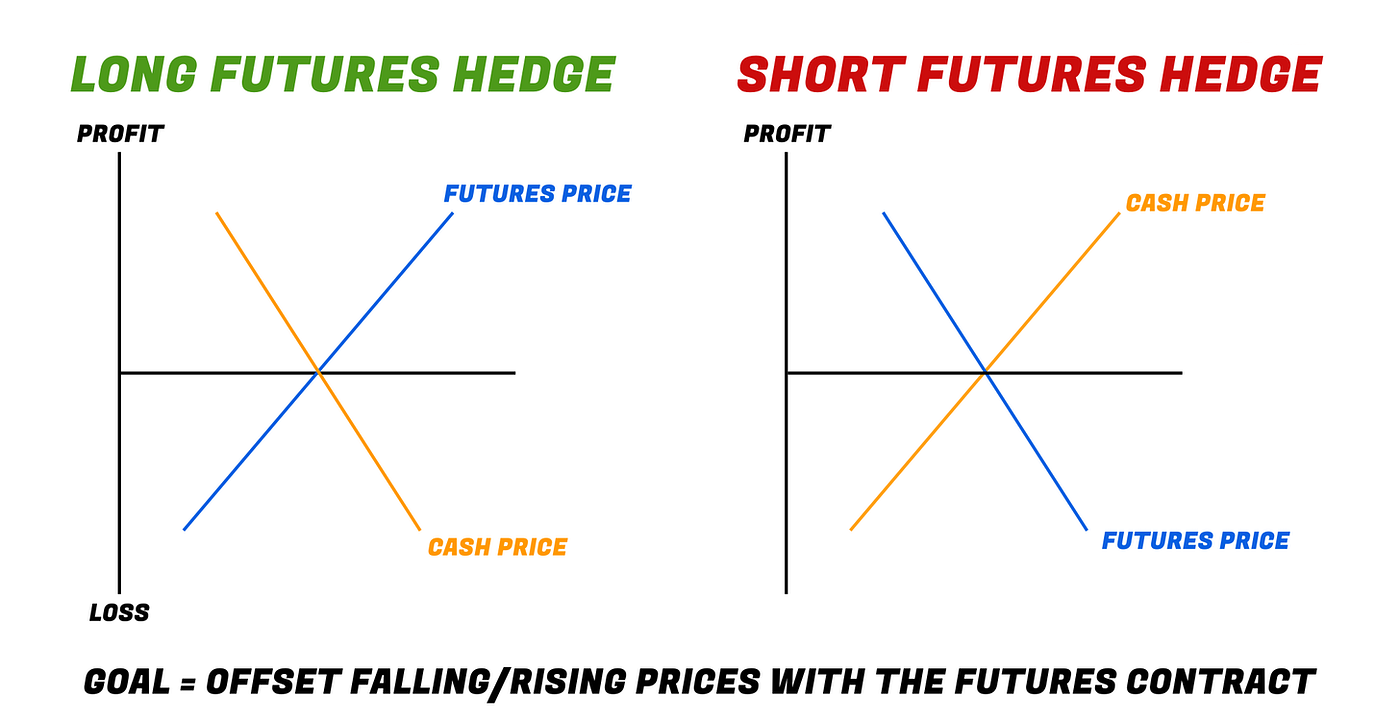

Long Hedge

To protect themselves against future price increases, investors who already have exposure to an asset or commodity utilize futures contracts to lock in a purchase price.

Short Hedge

In contrast, a short hedge protects investors against possible price declines by locking in a selling price through the use of futures contracts when they commit to selling an asset or commodity in the future.

Cross-Hedging

Cross-hedging is the use of futures contracts based on a related but distinct asset class to protect against risks in one asset class. For instance, a crude oil producer may use futures contracts based on heating oil prices as a hedge against price swings.

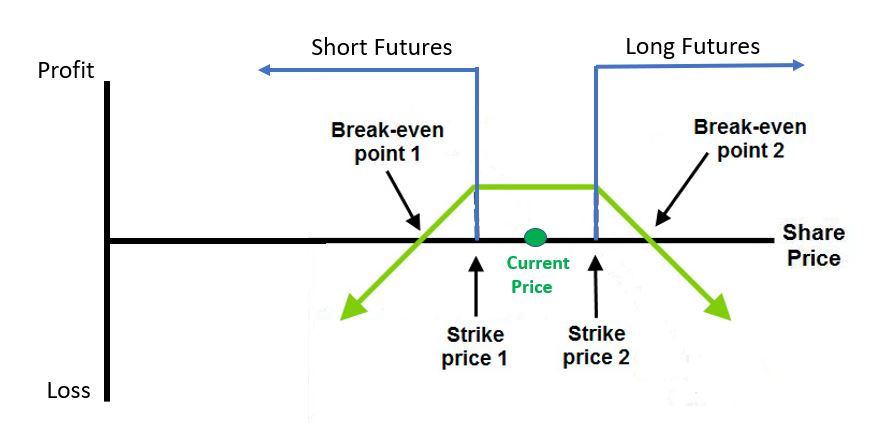

Delta Hedging

To minimize the impact of price fluctuations on the portfolio, delta hedging entails modifying the hedge ratio of futures contracts to maintain a neutral position to changes in the price of the underlying asset.

Explore More A Guide to Options Hedging: Weathering the Storm

Consequences of Futures Hedging

There are various advantages that futures hedging provides to market players.

Risk Mitigation

By using futures to hedge against potential losses in their portfolios, investors can lower their exposure to market volatility.

Enhanced Stability

Investors can obtain more stability and predictability in their investment returns by hedging against unfavourable price changes. This lowers uncertainty and improves risk-adjusted performance.

Cost-Effectiveness

When considering alternative risk management techniques like options or over-the-counter derivatives, futures contracts offer a more economical way to hedge.

Market Liquidity

The high levels of transparency and liquidity provided by futures markets make it easier to execute hedging strategies and save transaction costs.

The Difficulties of Futures Trading

Even with its benefits, futures hedging has drawbacks and restrictions for market players:

Basis Risk

This type of risk can lead to less-than-ideal hedging results when there is an imperfect link between the price movements of futures contracts and the underlying assets that are being hedged.

Rolling Costs

In volatile markets, rolling futures contracts continuously to keep hedging positions may result in transaction costs and eventually reduce returns.

Margin Requirements

Posting initial and maintenance margins is necessary for futures hedging, which ties up funds and could reduce liquidity for other investing opportunities.

Counterparty Risk

Because futures contracts are cleared by central counterparties and exchanged on exchanges, they are vulnerable to counterparty risk. For hedgers, a counterparty default could result in financial losses.

In Summary

In summary, futures hedging is an effective strategy for risk management and safeguarding portfolios against unfavourable changes in financial market prices. Investors can reduce their exposure to market volatility, improve stability, and increase the predictability of their investment returns by judiciously utilizing futures contracts. Hedging with futures, however, comes with several difficulties and complications that call for cautious thought and risk management. Through comprehension of the concepts, tactics, and consequences of hedging with futures, players in the financial markets can confidently and resiliently traverse the turbulent seas of the markets.